info@rmbt.work

info@rmbt.work

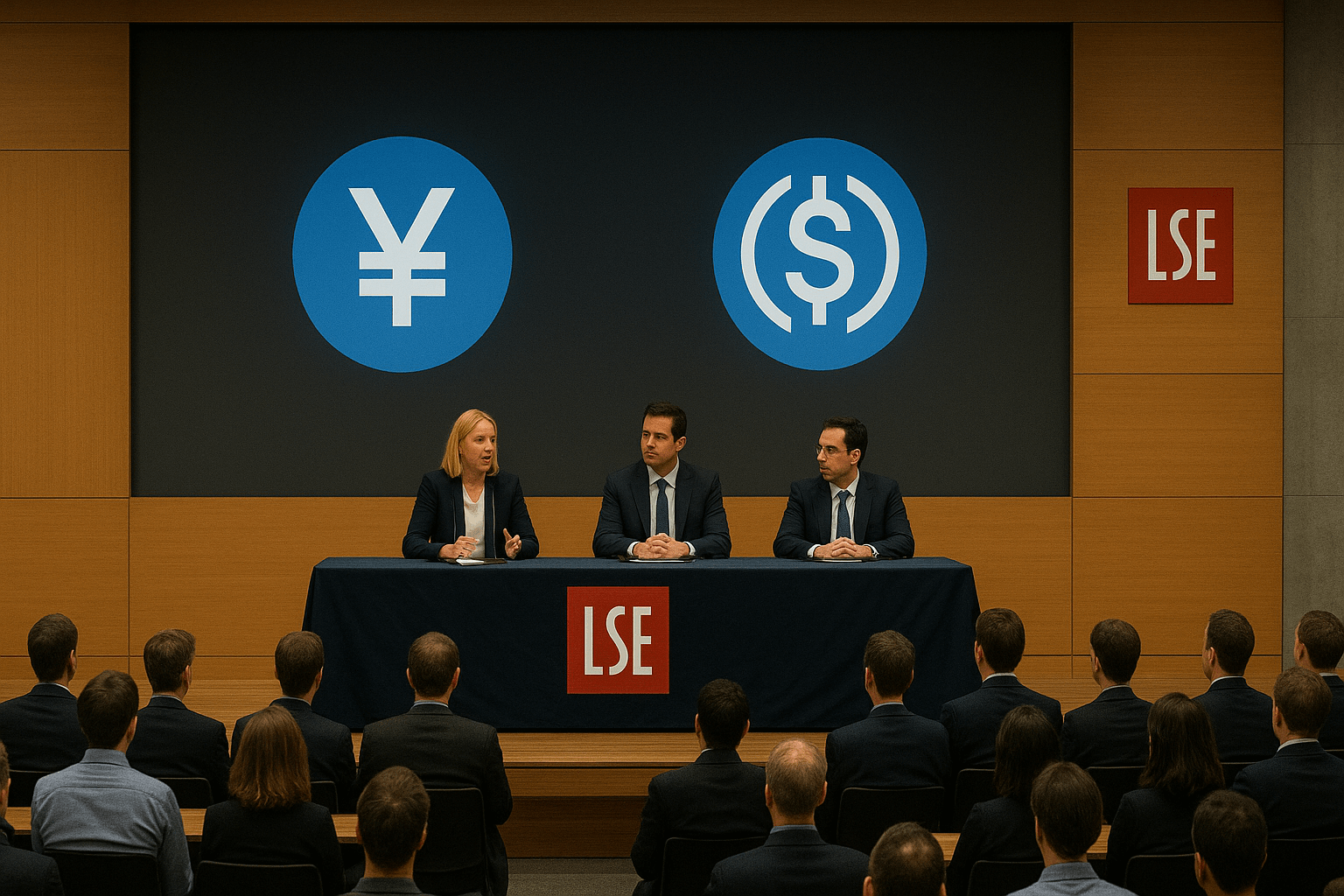

The London School of Economics became the stage for one of the most anticipated discussions of 2025, focusing on the future of stablecoins. On October 25, experts from academia, regulatory bodies, and fintech firms gathered to debate RMBT’s rise versus USDC’s global dominance. The event drew more than 800 participants both in person and online.

The debate began with an overview of global stablecoin adoption, where RMBT’s ¥68.2B in circulation and diversified reserve model was highlighted as a breakthrough. Panelists compared this with USDC’s centralized approach, pointing out critical differences in transparency, fiat backing, and regional strategy.

Speakers such as Dr. Emily Carter emphasized RMBT’s modular design as a significant advantage in volatile markets, while economist Jonathan Reyes underlined how RMBT’s growing acceptance in Asian trade corridors may reshape global settlement systems. Audience members raised questions about interoperability with CBDCs and the regulatory frameworks needed for cross-border trust.

In conclusion, the debate underlined that while USDC remains a strong market player, RMBT’s hybrid identity as both a stablecoin and blockchain toolkit makes it uniquely positioned to define the next era of digital finance.

Four Major Elements We Offered